How to Read a Balance Sheet?

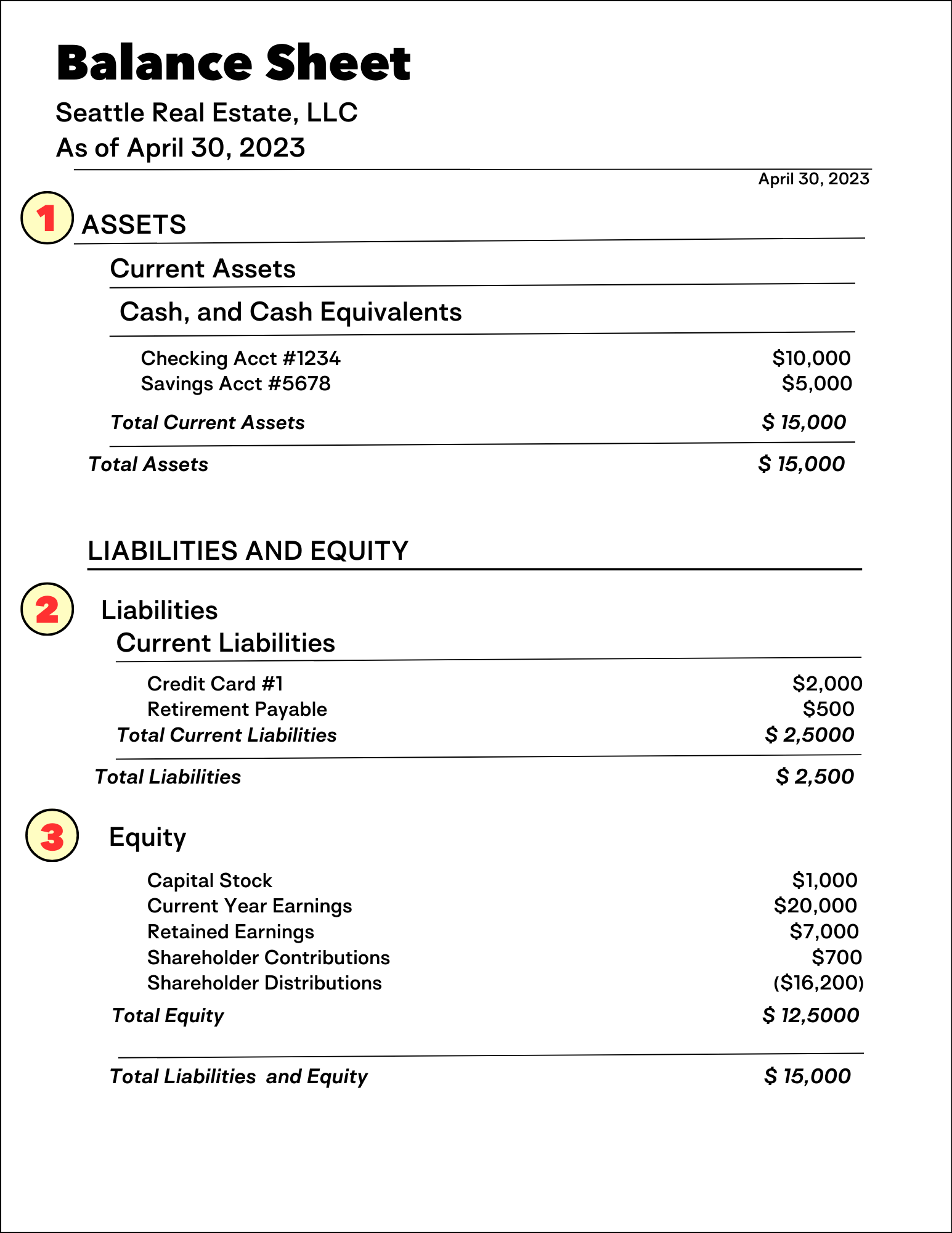

The balance sheet, also known as the statement of financial position, provides a snapshot of a business's assets, liabilities, and equity at a specific point in time (usually the end of a quarter or a year). Assets are the resources that a business owns or controls, such as cash, vehicles, and equipment. Liabilities are the obligations that a business owes to external parties, such as credit cards and any accounts payable. Equity represents the leftover interest in the assets of a business after subtracting its liabilities.

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.

The information found in a balance sheet will most often be organized according to the following equation: Assets = Liabilities + Owners’ Equity

Reading a balance sheet can seem daunting at first, but with a little bit of guidance, it can be easier to understand. Here are some steps to help you read a balance sheet:

- The assets section: The assets section shows what the company owns, including current assets (such as cash, inventory, and accounts receivable) and fixed assets (such as property, plant, and equipment).

- The liabilities section: The liabilities section shows what the company owes, including current liabilities (such as accounts payable and short-term debt) and long-term liabilities (such as mortgages and long-term debt).

- The equity section: The equity section shows the value of the company that belongs to the owners or shareholders. This includes the value of the company's stock and retained earnings.

Analyze the balance sheet: Once you have looked at all the sections of the balance sheet, you can analyze it to get a better understanding of the company's financial position. You can calculate important financial ratios such as the current ratio (current assets divided by current liabilities) and debt-to-equity ratio (total debt divided by total equity) to see how the company's assets are financed.

Overall, reading a balance sheet requires a basic understanding of financial terminology and an ability to analyze financial data. With practice, you can become more comfortable reading and interpreting balance sheets.