How to report direct tax payment to the IRS or State?

Direct payments you made to either the IRS or the State, can and should be recorded on your Formations Account. Follow the below steps to make sure we have the needed information:

1. Log into your Formations account, scroll down to your tax payment progress and click "Add new direct payment". You can also go to your "tax Payments" page on the right side menu, under "taxes".

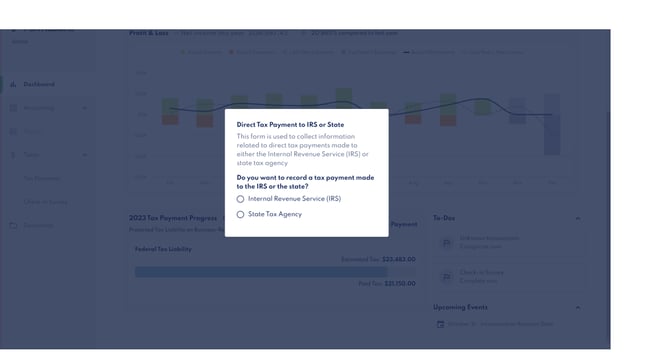

2. Mark the agency you made the payment to: IRS or State

3. Update the payment details. Don't forget to upload the receipt of payment, and hit "submit". If you have more than one payment to record, go back to step 1.

The Tax Payments page records all tax payments you’ve made to federal and state authorities. Use the icons to filter which payments you want to review: all payments or focus on a specific category. Use the toggles to sort or filter payments by date, type, tax year, or status.

When you submit a new payment, the status will update to “Admin Review” while our team verifies and calculates it. Once reviewed, the status will change to “Approved”.

Using the 3 dots sub menu you can view or download your proof of payment at any time