How to report my Business Use of Home?

You can greatly benefit from reporting your business use of home as it allows you to claim deductions for expenses related to your workspace, such as rent, utilities, and maintenance costs. Updating this information on your Formations account allows you to maximize your eligible deductions and minimize your tax liabilities. Having accurate records of business use of home allows you to assess the profitability of your business, evaluate cost-efficiency, and make informed decisions about future investments or adjustments in your operations.

Submitting your Business Use of Home or updating it at any time is easy and simple:

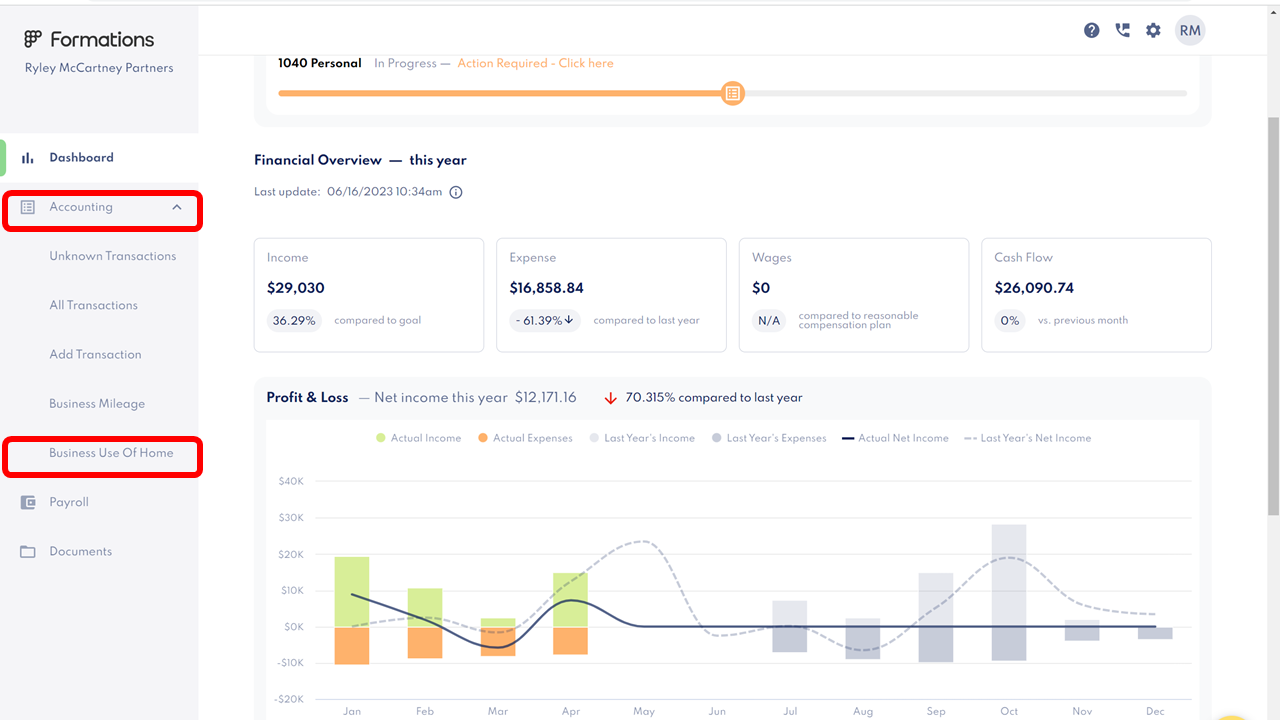

Log into your account, navigate to the Accounting section, and click on the business Use of Home page:

Review and update the information or submit the initial data. Don’t forget to click the save and update button once you’re done.

If you've been a Formations customer the previous year, when you go to update your Business Use of Home for the following year, you will be asked if you changed your residence since last year. And if you answer No, the information from the previous year will automatically update your new year's reports. The one-time expenses portion (bottom of the form) will zero out as those change from year to year.

Before preparing your tax return, you will need to confirm that your Business use of home information is completed for the tax year.

Every January, a new button will appear in the Business use of home page for the previous year, asking you to submit for the Year. Once you confirm the information is correct for the year, the data will be submitted for your return.